RBN Enegery LLC

Natural gas producers are probably turning green with envy: Processed condensate exports out of the US Gulf are strong and getting stronger. Since the Department of Commerce threw the doors open to the export of lightly processed condensate, new loading points have emerged, new target markets have been found, and more companies have become involved. Today we describe how attention is now turning from regulatory and logistical issues to the challenge of finding buyers.

The volume of very light crude oil with an API Gravity above 50 degrees being produced from U.S. shale plays such as the Eagle Ford and more recently the Permian, has expanded beyond the level of domestic demand (see Condensate City).

We have described the loosening of export regulations implemented by the Department of Commerce Bureau of Industry and Security (BIS) since June 2014, to allow lease condensate produced at the wellhead to be exported provided that it is first processed through a distillation tower and is kept segregated on its journey to export marine docks (see Ticket To Export).

Last week we detailed the expansion of Plains All American (PAA) and Enterprise Products Partners (EPD) infrastructure to transport processed condensate from the Permian and Eagle Ford Basins to Corpus Christi and Houston (see When Are You Gonna Come Down)

Natural gas producers are probably turning green with envy: Processed condensate exports out of the US Gulf are strong and getting stronger. Since the Department of Commerce threw the doors open to the export of lightly processed condensate, new loading points have emerged, new target markets have been found, and more companies have become involved. Today we describe how attention is now turning from regulatory and logistical issues to the challenge of finding buyers.

The volume of very light crude oil with an API Gravity above 50 degrees being produced from U.S. shale plays such as the Eagle Ford and more recently the Permian, has expanded beyond the level of domestic demand (see Condensate City).

We have described the loosening of export regulations implemented by the Department of Commerce Bureau of Industry and Security (BIS) since June 2014, to allow lease condensate produced at the wellhead to be exported provided that it is first processed through a distillation tower and is kept segregated on its journey to export marine docks (see Ticket To Export).

Last week we detailed the expansion of Plains All American (PAA) and Enterprise Products Partners (EPD) infrastructure to transport processed condensate from the Permian and Eagle Ford Basins to Corpus Christi and Houston (see When Are You Gonna Come Down)

Maturing Market

Initial exports of Eagle Ford condensate in the summer of 2014 (mostly to Asia) did not necessarily make economic sense because the prices paid were not attractive to shippers once freight costs were factored in. (see No Particular Place to Go). The first few cargoes could be chalked up to the need to prove that “it can be done” – that the logistics work, and that the quality of the material is adequate. That proof-of-concept phase is over. Four cargoes of condensate shipped between the first of the year and the end of February 2015. In March, another five cargoes loaded in the US Gulf, followed quickly by three cargoes in the first few days of April. Clearly Eagle Ford condensate is successfully competing with condensate range material in global markets.

A couple of early issues arose with processed condensate exports. First some traders alleged that buyers had concerns about the lack of consistency in the quality of the product being shipped. However, this does not seem to be depressing the appetite of end users. In fact, many of the cargoes are going to the same buyer. Another early issue was access to an export dock – an issue complicated by the need to segregate processed condensate (see Enterprise Condensate Routes to Market). Cargoes were being exported exclusively from the EPD dock in Texas City and then from what used to be the Oiltanking Houston terminal that is also now owned by EPD (see Starship Enterprise). This limitation to global market access led to some grumbling.

The Wall Street Journal reported that BP complained to the Federal Trade Commission that EPD was abusing its position in the port of Houston and Texas City. EPD brushed off the complaints, telling analysts that companies wanting a service should pay for it, according to Reuters. Since then, an export cargo has loaded at the Texas International Terminal in the Galveston Ship Channel, and another one at the dock jointly owned by NuStar and Martin Midstream in Corpus Christi. The condensate likely came out of Martin Midstream’s tanks because NuStar does not have separate tankage for condensate at that location.

Other operators in Corpus Christi, most notably Plains, are gearing up to handle condensate as well, offering shippers more choice. Flint Hills (part of Koch Industries) and Occidental Petroleum (Oxy) are in an even better position to handle condensate exports because their Ingleside docks at Corpus are outside the congested port channel area and can accommodate bigger ships with a deeper draught.

Diversification of Discharge Destinations

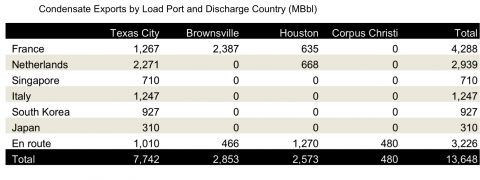

Table #1 shows ClipperData numbers for condensate exports by load port and discharge country so far (June 2014 through March 2015). Texas City has the largest throughput – close to 8MMBbl. The stealth player among export ports has been Brownsville on the Gulf Coast Texas/Mexico border with close to 3 MMBbl loaded – more than Houston or Corpus.

Initial exports of Eagle Ford condensate in the summer of 2014 (mostly to Asia) did not necessarily make economic sense because the prices paid were not attractive to shippers once freight costs were factored in. (see No Particular Place to Go). The first few cargoes could be chalked up to the need to prove that “it can be done” – that the logistics work, and that the quality of the material is adequate. That proof-of-concept phase is over. Four cargoes of condensate shipped between the first of the year and the end of February 2015. In March, another five cargoes loaded in the US Gulf, followed quickly by three cargoes in the first few days of April. Clearly Eagle Ford condensate is successfully competing with condensate range material in global markets.

A couple of early issues arose with processed condensate exports. First some traders alleged that buyers had concerns about the lack of consistency in the quality of the product being shipped. However, this does not seem to be depressing the appetite of end users. In fact, many of the cargoes are going to the same buyer. Another early issue was access to an export dock – an issue complicated by the need to segregate processed condensate (see Enterprise Condensate Routes to Market). Cargoes were being exported exclusively from the EPD dock in Texas City and then from what used to be the Oiltanking Houston terminal that is also now owned by EPD (see Starship Enterprise). This limitation to global market access led to some grumbling.

The Wall Street Journal reported that BP complained to the Federal Trade Commission that EPD was abusing its position in the port of Houston and Texas City. EPD brushed off the complaints, telling analysts that companies wanting a service should pay for it, according to Reuters. Since then, an export cargo has loaded at the Texas International Terminal in the Galveston Ship Channel, and another one at the dock jointly owned by NuStar and Martin Midstream in Corpus Christi. The condensate likely came out of Martin Midstream’s tanks because NuStar does not have separate tankage for condensate at that location.

Other operators in Corpus Christi, most notably Plains, are gearing up to handle condensate as well, offering shippers more choice. Flint Hills (part of Koch Industries) and Occidental Petroleum (Oxy) are in an even better position to handle condensate exports because their Ingleside docks at Corpus are outside the congested port channel area and can accommodate bigger ships with a deeper draught.

Diversification of Discharge Destinations

Table #1 shows ClipperData numbers for condensate exports by load port and discharge country so far (June 2014 through March 2015). Texas City has the largest throughput – close to 8MMBbl. The stealth player among export ports has been Brownsville on the Gulf Coast Texas/Mexico border with close to 3 MMBbl loaded – more than Houston or Corpus.

The emergence of the Transmontaigne (part of NGL Energy Partners) terminal in Brownsville as an export port for condensate took many by surprise. The facility is a rail-to-ship transloading point – meaning that processed condensate has to be shipped there by rail. As the number of export loading docks grows, so does the range of destination markets.

Brownsville exports, for example, went exclusively to Fos in southern France, but the last ship to load there is now waiting to discharge off the coast of England opposite Rotterdam (Netherlands).

Of the first five cargoes loaded in the US, one went to the Dutch port. Since then, Rotterdam has become the second largest receipt point for Eagle Ford Condensate after Fos (see right hand column in Table #1).

Table #1, Source ClipperData

Asian buyers were an early target for condensate exporters. Three of the first five cargoes went to Asia, one each to Japan, South Korea and Singapore in the summer of 2014. Since then there has been a long hiatus in the flow of Eagle Ford Condensate to Asia, but that has now ended with Shell recently taking about 0.5 MMBbl to Singapore via the Cape of Good Hope.

To read the rest of the artilce, click on link below: https://rbnenergy.com/what-condition-my-condensate-was-in-growing-exports-seek-new-buyers

No comments:

Post a Comment