and Alex Longley and Jacqueline Davalos

Bloomberg

Bloomberg

Oil plunged as both Russia and Saudi Arabia stood poised to flood the market with cheap crude in an all-out price war just as the coronavirus is spurring the first contraction in demand since 2009.

The former allies pledged swift retribution for the collapse of the OPEC+ alliance meeting last week. The Gulf kingdom has slashed its official crude prices and is threatening record output. Russia’s largest producer, meanwhile, said it will ramp up production next month.

The former allies pledged swift retribution for the collapse of the OPEC+ alliance meeting last week. The Gulf kingdom has slashed its official crude prices and is threatening record output. Russia’s largest producer, meanwhile, said it will ramp up production next month.

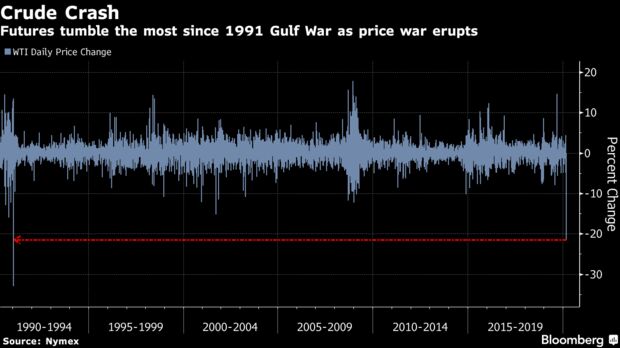

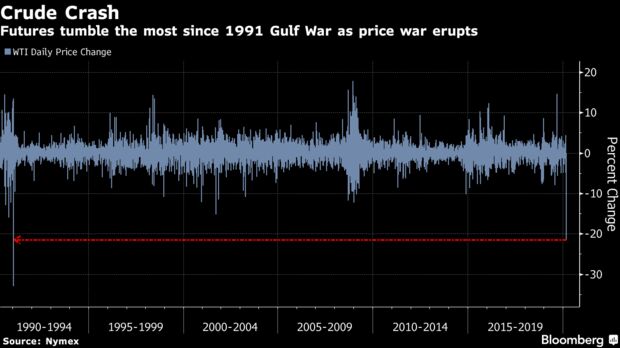

Oil futures fell more 30 percent in New York and London on Monday, the biggest drop since the Gulf War in 1991, before pulling back to around a 20 percent decline.

The freefall ricocheted across financial markets. U.S. stocks plunged almost 6 percent the S&P 500 index down 18 percent from its Feb. 19 all-time high. All of the annual growth the International Energy Agency had anticipated last month -- just over 800,000 barrels a day -- has been wiped out and demand is now expected to contract by 90,000 barrels a day.

“The situation we are witnessing today seems to have no equal in oil market history,” said IEA Executive Director Fatih Birol. “A combination of a massive supply overhang and a significant demand shock at the same time.”

The cataclysmic price collapse will resonate through the energy industry, from giants like Exxon Mobil Corp., which saw its stock drop the most in 11 years, to smaller shale drillers in West Texas.

It will hit the budgets of oil-dependent nations from Iraq to Nigeria and could also reshape global politics, eroding the influence of countries like Saudi Arabia. The fight against climate change may suffer a setback as fossil fuels become more competitive against renewable energy.

“Markets are bracing for oil prices in the 20s,” said Ellen Wald, president of Transversal Consulting and a nonresident fellow at the Atlantic Council’s Global Energy Center. “I don’t think production can win this war. There’s not enough demand for it. That’s the difference between 2014 and today.”

Brent for May settlement tumbled as much as $14.25 a barrel to $31.02 on the London-based ICE Futures Europe Exchange. West Texas Intermediate crude for April slumped as much as 34 percent to $27.34 a barrel on the New York Mercantile Exchange before paring losses to 19 percent

“It’s just a nightmare,” said Tamas Varga, an analyst at PVM Oil Associates Ltd. in London.

The freefall ricocheted across financial markets. U.S. stocks plunged almost 6 percent the S&P 500 index down 18 percent from its Feb. 19 all-time high. All of the annual growth the International Energy Agency had anticipated last month -- just over 800,000 barrels a day -- has been wiped out and demand is now expected to contract by 90,000 barrels a day.

“The situation we are witnessing today seems to have no equal in oil market history,” said IEA Executive Director Fatih Birol. “A combination of a massive supply overhang and a significant demand shock at the same time.”

The cataclysmic price collapse will resonate through the energy industry, from giants like Exxon Mobil Corp., which saw its stock drop the most in 11 years, to smaller shale drillers in West Texas.

It will hit the budgets of oil-dependent nations from Iraq to Nigeria and could also reshape global politics, eroding the influence of countries like Saudi Arabia. The fight against climate change may suffer a setback as fossil fuels become more competitive against renewable energy.

“Markets are bracing for oil prices in the 20s,” said Ellen Wald, president of Transversal Consulting and a nonresident fellow at the Atlantic Council’s Global Energy Center. “I don’t think production can win this war. There’s not enough demand for it. That’s the difference between 2014 and today.”

Brent for May settlement tumbled as much as $14.25 a barrel to $31.02 on the London-based ICE Futures Europe Exchange. West Texas Intermediate crude for April slumped as much as 34 percent to $27.34 a barrel on the New York Mercantile Exchange before paring losses to 19 percent

“It’s just a nightmare,” said Tamas Varga, an analyst at PVM Oil Associates Ltd. in London.

To rad rest of article, click on link: https://www.bloomberg.com/news/articles/2020-03-08/oil-in-freefall-after-saudis-slash-prices-in-all-out-crude-war

7 comments:

LET ME GET THIS RIGHT. TEACHER UNIONS ENDORSED RUBEN CORTEZ WHO HAS NO HIGHER EDUCATION. GOT IT.

HOW DID THAT WORK OUT?

Juan is it true the new worth of eddie lucio jr is $87 Million? tell me im wrong, you should do an article on all that mulah, does this include the $22 million from the port of browsville bridge to NOWHERE that somehow got lost? Very interesting, i know nothing.

What difference does it make if you are infected? With spring breakers, the port, the airport, the bridges there is a chance of this area becoming a ghost place. THERE ARE NO PLANS OF ANY KIND TO PROTECT THIS AREA NOTHING

juan its the end of the world, too much sin and bad in the world. God will punish us for all the wrong we do.

1.89 gallon of gas everywhere. Too bad I use a bike lol

Bike trails will replace city streets real soon. Its coming just like the bironga-biros.

@March 9, 2020 at 3:34 PM

So the GED at the library is getting paid 90k a year DO YOU THINK YOU CAN GET THAT ONE? GUEY

Ooooh he's a gringo he's allowed to do that. Meskins need a degree

Post a Comment