Washington Post

The Treasury announced late Wednesday that Social Security beneficiaries who typically do not file a tax return will automatically get the $1,200 payment.

The announcement is a reversal from earlier in the week when the Internal Revenue Service said everyone would need to file some sort of tax return in order to qualify for the payments. Democrats and some Republicans criticized the IRS for requiring so many extra hurdles for this vulnerable population to get aid when the government already has their information on file.

The reversal came as the Trump administration tries to rapidly get stimulus payments out to Americans in the face of the quickest economic decline in modern history.

“Social Security recipients who are not typically required to file a tax return need to take no action, and will receive their payment directly to their bank account,” said Treasury Secretary Steven T. Mnuchin.

The $2.2 trillion aid legislation passed in response to the coronavirus pandemic, directed the Treasury to look at Americans’ 2019 or 2018 tax returns to determine if they are eligible for a payment. But the law also said Treasury should look at Social Security data for seniors and the disabled.

Criticism poured in after the IRS posted a noticeon its website on Monday instructing Social Security recipients who do not normally send in a return to file a “simple” tax return, which would be available soon.

More than 15 million Americans on Social Security do not file an annual tax return because their income is so low, according to the Center on Budget and Policy Priorities.

Forty-one Democratic senators sent the White House a lettef Wednesday asking why the Trump administration is placing this “significant burden” on senior citizens and the disabled. GOP Sen. Josh Hawley of Missouri called it “ridiculous."

During the last recession, when the U.S. government sent most Americans a stimulus check and required a filed tax return to get it, 3.5 million Social Security recipients were left out because they never sent a return, according to a 2008 Treasury Department analysis.

There were concerns that even more people won’t file during the pandemic. But the Trump administration ultimately reversed course.

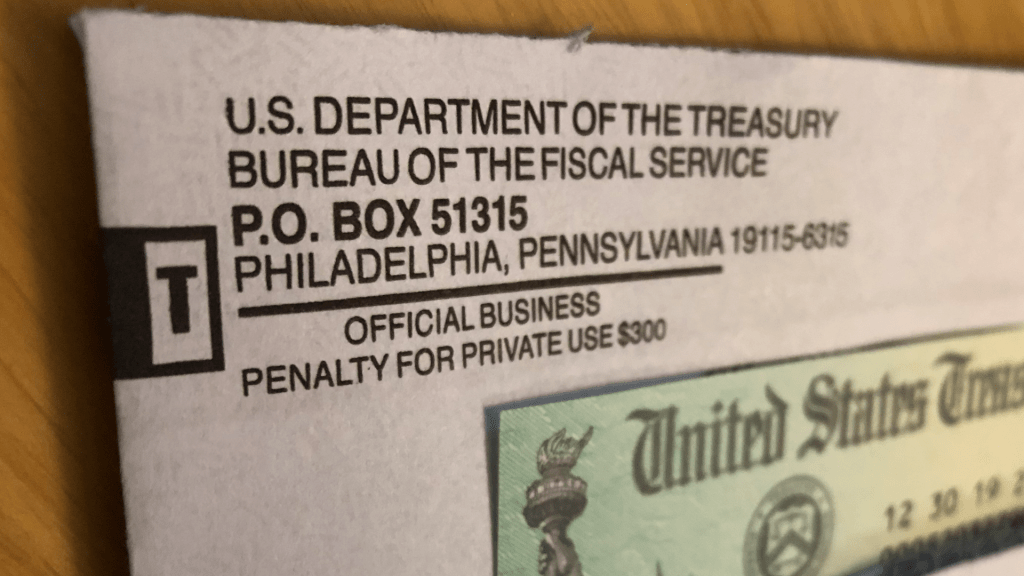

Mnuchin said direct deposits should begin by April 17, followed by checks in the mail. About 60 percent of tax filers gave the IRS direct-deposit information in recent years, said Nicole Kaeding of the National Taxpayers Union Foundation. The IRS said there would soon be a web-based portal for people to update their direct-deposit information.

The Treasury announced late Wednesday that Social Security beneficiaries who typically do not file a tax return will automatically get the $1,200 payment.

The announcement is a reversal from earlier in the week when the Internal Revenue Service said everyone would need to file some sort of tax return in order to qualify for the payments. Democrats and some Republicans criticized the IRS for requiring so many extra hurdles for this vulnerable population to get aid when the government already has their information on file.

The reversal came as the Trump administration tries to rapidly get stimulus payments out to Americans in the face of the quickest economic decline in modern history.

The $2.2 trillion aid legislation passed in response to the coronavirus pandemic, directed the Treasury to look at Americans’ 2019 or 2018 tax returns to determine if they are eligible for a payment. But the law also said Treasury should look at Social Security data for seniors and the disabled.

Criticism poured in after the IRS posted a noticeon its website on Monday instructing Social Security recipients who do not normally send in a return to file a “simple” tax return, which would be available soon.

More than 15 million Americans on Social Security do not file an annual tax return because their income is so low, according to the Center on Budget and Policy Priorities.

Forty-one Democratic senators sent the White House a lettef Wednesday asking why the Trump administration is placing this “significant burden” on senior citizens and the disabled. GOP Sen. Josh Hawley of Missouri called it “ridiculous."

During the last recession, when the U.S. government sent most Americans a stimulus check and required a filed tax return to get it, 3.5 million Social Security recipients were left out because they never sent a return, according to a 2008 Treasury Department analysis.

There were concerns that even more people won’t file during the pandemic. But the Trump administration ultimately reversed course.

Mnuchin said direct deposits should begin by April 17, followed by checks in the mail. About 60 percent of tax filers gave the IRS direct-deposit information in recent years, said Nicole Kaeding of the National Taxpayers Union Foundation. The IRS said there would soon be a web-based portal for people to update their direct-deposit information.

4 comments:

Not you, Montoya. You're really from Mexico.

Soooon how soon veeerrry sooooon...

when I get my 1200 bucks I'm going to buy a bottle of don julio un amaretto and a bottle of crown royal and invite all my friends abt 8 of them so we won't break the crowd rules y dale gas.

April 2 at 4:20 PM...it’s just like a Mexican to use government money for alcohol and dope.

Post a Comment